Professional by Design: How Pilots Present Themselves

Across business aviation, operators often rely on flexible staffing models by utilizing independent contract pilots. These contingent relationships allow flight departments to meet mission demands efficiently, but they also introduce important considerations for how those relationships are structured and represented.

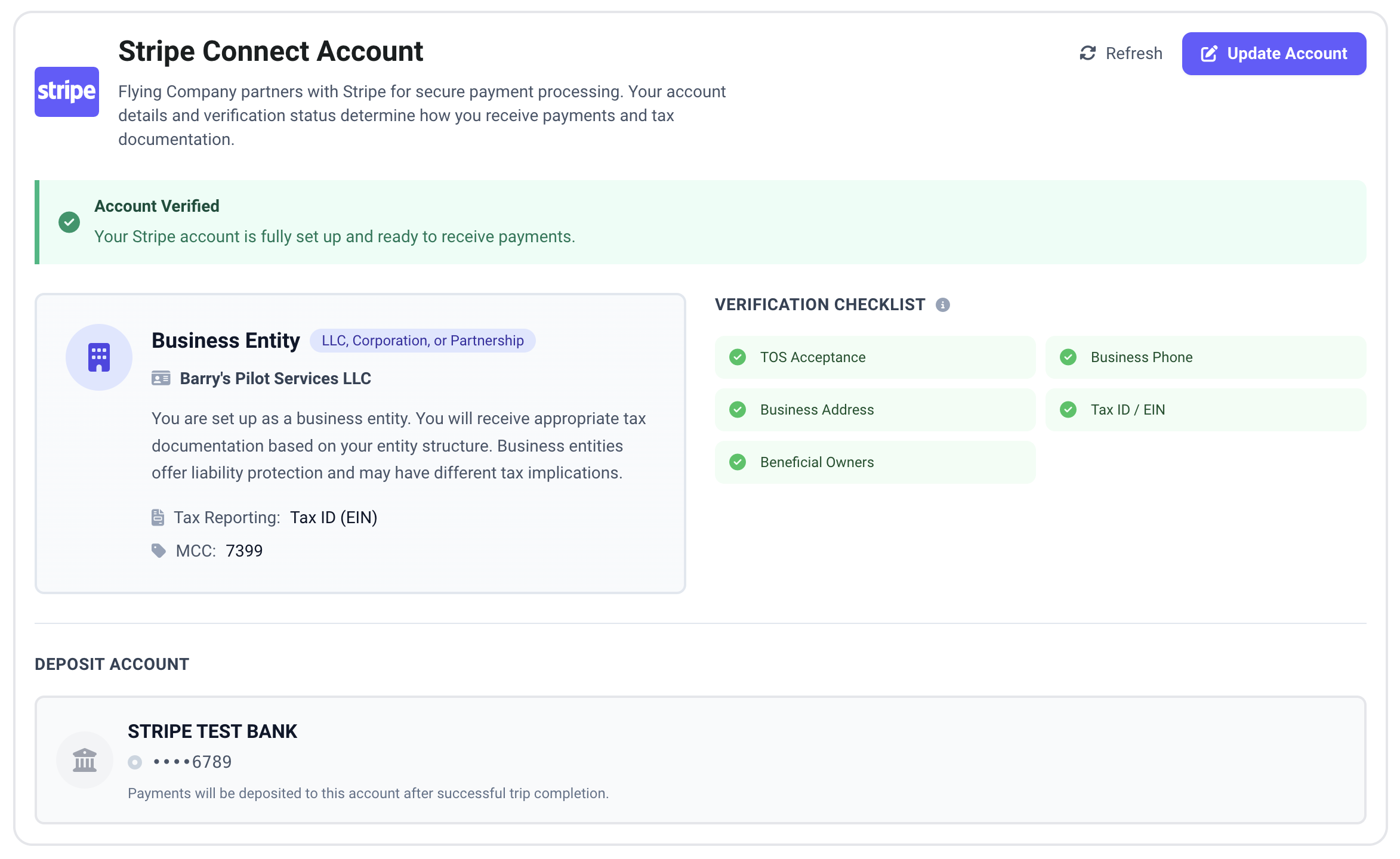

That’s why we’re excited to introduce an update to Flying Company’s Billing & Payments section that provides new visibility into how pilots operate professionally — whether as independent contractors or as business entities (LLC, Corporation, or Partnership).

This new feature was built directly in response to feedback from aircraft management companies who wanted a clearer, more transparent view of their pilot workforce.

Why This Matters for Operators

For aircraft operators, proper classification and documentation aren’t just a legal concern — they’re part of responsible risk management. The NBAA Best Practices for Utilizing Independent Contractors reminds managers that the most important step in any engagement is to make an educated determination about a worker’s classification and ensure that both sides understand their obligations .

By allowing pilots to self-identify their business type through our Stripe Connect integration, operators can now easily see:

- Whether a pilot is operating as an independent contractor or a registered business;

- That pilot’s verification status (Tax ID or EIN vs. SSN);

- Confidence that payments, reporting, and documentation flow accordingly.

This doesn’t replace professional legal or HR review, but it provides a simple, transparent starting point — reducing ambiguity and creating a cleaner paper trail.

Why This Matters for Pilots

For professional pilots who operate their own business entity, this feature is more than administrative — it’s a way to showcase professionalism. Pilots who form LLCs often do so for liability protection, financial structure, and to serve multiple clients. Now, those pilots can easily represent that structure within their Flying Company profile, helping operators see how they engage from a business perspective.

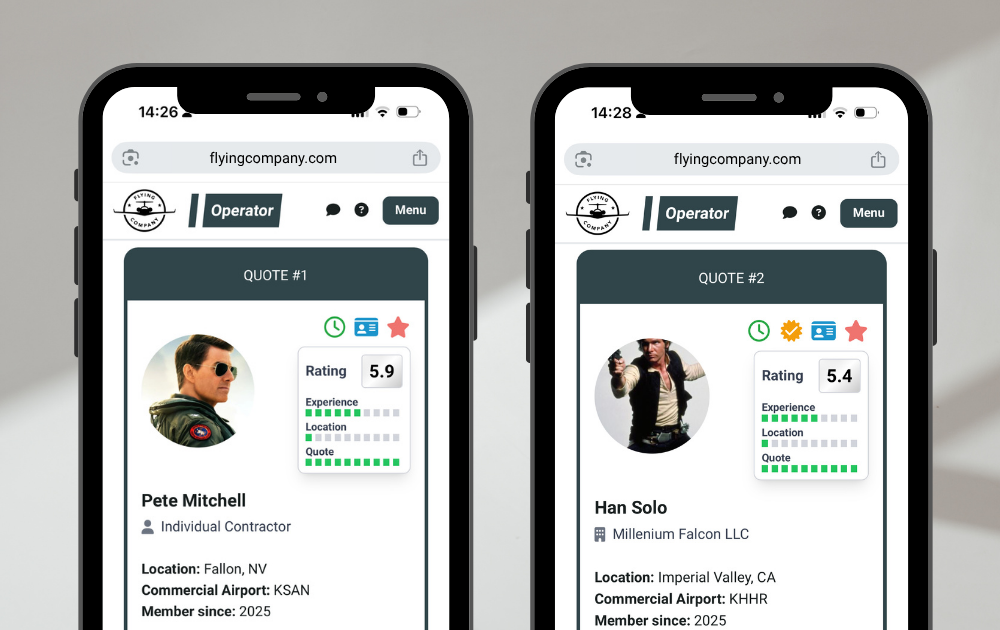

As NBAA’s guidance highlights, independent contractors are most clearly distinguished when they maintain business independence — for example, by setting their own rates, carrying their own insurance, and providing services to multiple clients. Flying Company’s platform now helps capture that professional reality.

Bridging the Information Gap

Worker classification rules vary by state and context, but the principle remains the same: both sides benefit when there’s transparency. Operators get peace of mind, pilots present themselves accurately, and payments and tax reporting are streamlined for both parties.

This update is one small part of a larger goal — making sure that everyone on a flight operation team has the information they need to collaborate smoothly and professionally.

In Practice

In addition to the updated Billing & Payments section, each pilot’s profile now clearly shows whether they operate as a Business Entity or as an Independent Contractor. This simple visual cue helps ensure that everyone — from schedulers to safety officers to accounting — is on the same page.

Looking Ahead

As the business aviation landscape continues to evolve, Flying Company will keep developing tools that help operators and pilots work together responsibly, transparently, and efficiently.

Whether you fly a single jet or manage a national fleet, our goal is to make professional alignment — not paperwork — the easiest part of your next trip.

References:

Adapted in part from NBAA Best Practices for Utilizing Independent Contractors (2012)